Over the past couple of weeks, Ripple XRP has seen a 20x surge in market cap, fueled by new banking partnerships, and renewed interest from investors.

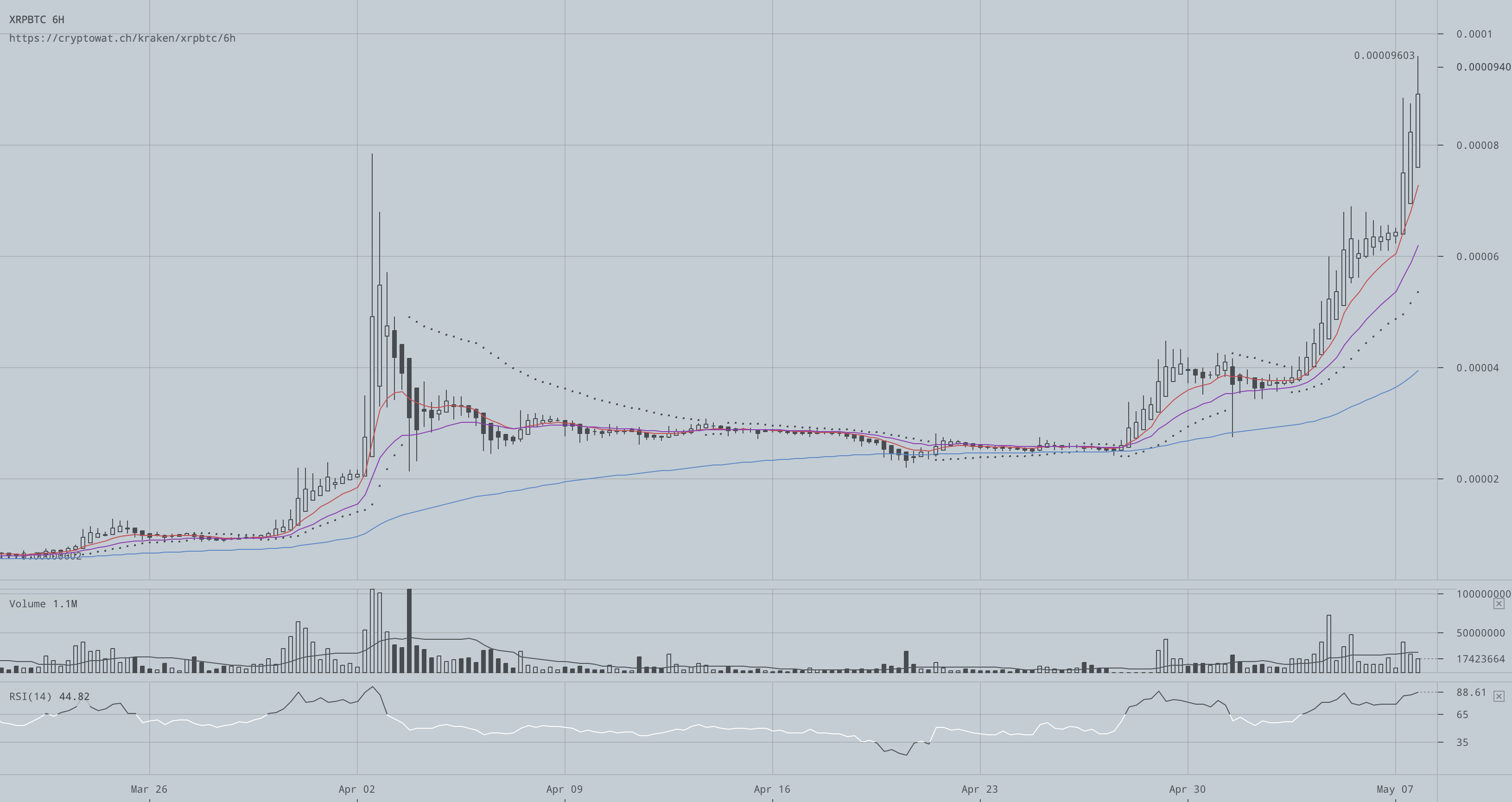

XRP growth

| Date | Market Cap | Supply | Volume (24h) | Price |

|---|---|---|---|---|

| 05.03 | $236,342,055 | 37,406,829,143 XRP | $951,998 | $0.006318 |

| 02.04 | $928,867,446 | 37,388,960,792 XRP | $31,735,912 | $0.024843 |

| 07.05 | $4,781,112,493 | 37,955,579,225 XRP | $173,069,000 | $0.125966 |

XRP volume by exchange

Over 77% of all XRP trading happens on Poloniex, followed by 5.57% on Kraken and 3.26% on Bittrex.

| Exchange | Pair | Volume (24h) | Price | Volume |

|---|---|---|---|---|

| Poloniex | XRP/BTC | $129,093,000 | $0.122940 | 72.80% |

| Kraken | XRP/BTC | $9,880,580 | $0.124562 | 5.57% |

| Poloniex | XRP/BTC | $8,255,380 | $0.119286 | 4.66% |

| Bittrex | XRP/BTC | $5,777,520 | $0.125561 | 3.26% |

07.05.2017 on coinmarketcap.com

Major difference to Bitcoin

Unlike Bitcoin, Ripple’s main goal is to establish a global payment network, that allows banks to transfer value faster, cheaper and with less risk compared to traditional settlement networks.

Ripple for banks

According to their website, banks can save between $3.48 USD and $38.18+ USD per transaction, depending on annual volume, and essentially their current system (failure rate, need for manual intervention, settlement time). You can have a look at the cost model on the Ripple Website.

So, Ripple doesn’t effectively need to reach the endusers, but works with financial institutions to reduce their cost. They don’t need to convince anyone to trade their USD to BTC / ETH / LTC but much rather, they convince big banks to use their tech, to reduce their cost, to make more money. However, there’s been much debate over whether these banks actually transact in XRP.

The following video takes a closer look at how settlement works and at which point the balances reflects in the ledger. The most important piece is the ILP (Interledger Protocol):

Ripple for Enduser

With more banks joining the Ripple network, the enduser benefits from lower cost and faster value transfer. The network determines the best route, calculates fees and initiates funds transfer upon approval.

XRP as investment

With more money pouring into crypto, XRP should remain an attractive option for both private and institutional investors.

- Supply is forever limited to 100,000,000,000 XRP

- Ripple plans to cross-sell XRP to add liquidity to the market

- Every transaction destroys 0.00001 XRP (Visa handles on average 150 million / day. If Ripple reaches this scale, we would destroy 1,500 XRP / day, or 547,500 / year.)

In Q1 alone, Ripple (XRP II) has sold over $6.7MM worth of XRP directly.

In Q1 market participants purchased $6.7MM directly from XRP II, LLC*, Ripple’s registered and licensed money service business (MSB). These buyers tend to be institutional in nature and their purchases include restrictions that help mitigate the risk of market instability due to large subsequent sales. - ripple.com

More on that in the Q1 2017 XRP Markets Report

XRP Supply

Worries among investors remain, as Ripple still holds the majority of the XRP. Should Ripple decide to release more XRP into the market, the value of current holdings would deprecate.

In Circulation: 37,955,579,225 XRP

Total supply: 100,000,000,000 XRP

XRP lock-up (Rumor)

Rumors around the internet speak of the possible announcement of a permanent lock-up of a large number of XRP that remain under Ripples control. This would ease worries among investors, and ensure that XRP supply remains at current levels, with prospects for continued growth.

Join a talk from @justmoon, the CTO of @Ripple, as he talks about different consensus mechanisms at #Consensus2017. https://t.co/0TijqCWV1O pic.twitter.com/v4SI2l9AWB

— CoinDesk (@coindesk) May 1, 2017

For more about this: Ripple announcing lock-up next month and Locking up Ripple’s XRP with Crypto Conditions